Introduction

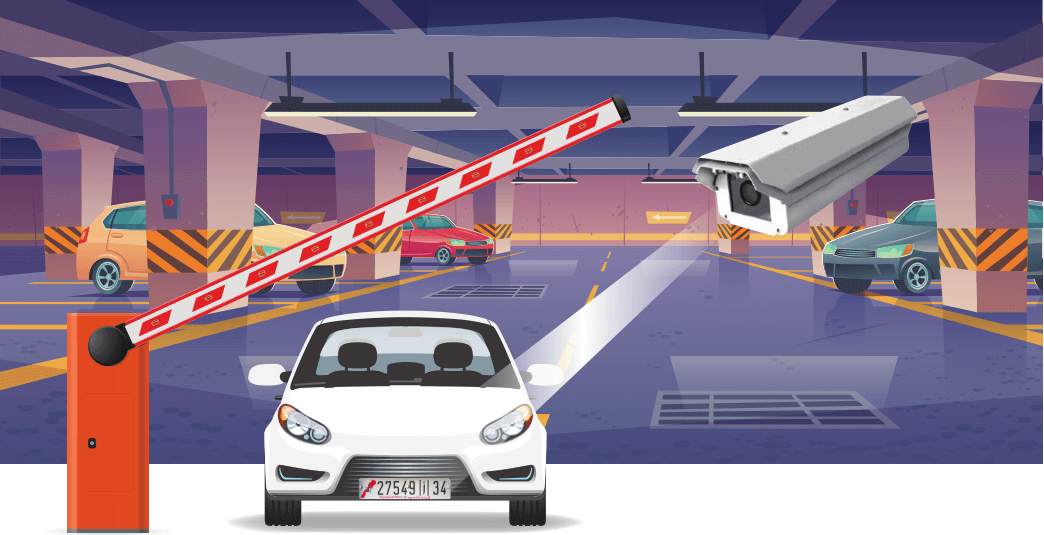

In Morocco, managing private parking facilities poses unique challenges, particularly in combating fraud. Indeed, issues such as unauthorized access and payment manipulation have become increasingly prevalent. Fortunately, Fraud Detection Using Machine Learning has emerged as a powerful solution to address these concerns.

This case study will explore how a Moroccan private parking company successfully implemented machine learning techniques. By doing so, the company was able to significantly enhance its fraud detection capabilities and improve overall security. Furthermore, we will delve into the specific strategies employed and the impressive results achieved.

Background

The Moroccan private parking industry faces escalating problems with fraudulent activities. Specifically, a leading parking operator in Morocco grappled with issues such as unauthorized access to parking areas, fraudulent payment claims, and permit misuse. Given these challenges, traditional fraud detection methods were proving insufficient.

Consequently, the company sought advanced solutions. The focus then shifted to fraud detection using machine learning, which was seen as a more effective approach to better manage and secure their parking operations.

Challenges

Key Fraud Detection Issues in Moroccan Private Parking

Unauthorized Access: The company faced significant problems with fraudulent entry to parking spaces, which traditional systems struggled to detect.

Payment Fraud: Instances of payment manipulation were causing revenue losses and affecting financial integrity.

Permit Misuse: Unauthorized use of parking permits was frequent, impacting both security and revenue.

Implementation of Machine Learning

How Machine Learning Transforms Fraud Detection in Private Parking

1. Data Collection and Preparation

To address these challenges, the parking company started by gathering a comprehensive dataset that included:

Transaction Data: Records of parking payments, which detailed amounts, times, and payment methods. This data provided crucial insights into payment patterns and potential anomalies.

Access Logs: Information from automated gates and security cameras that monitored entry and exit. These logs were essential for identifying unauthorized access and unusual activity.

Permit Data: Details on issued permits and their usage patterns. This information helped in understanding permit validity and detecting misuse.

Subsequently, this data was meticulously cleaned and structured, creating a robust foundation for the implementation of machine learning for fraud detection. By preparing the data thoroughly, the company ensured that the ML models would be effective and accurate in identifying fraudulent activities.

2. Model Selection

The company employed a combination of supervised and unsupervised machine learning models to address different types of fraud:

Specifically, a classification model was developed to identify fraudulent transactions and unauthorized access. This model leveraged historical data to learn from past incidents and therefore predict potential fraud cases with greater accuracy.

In addition, anomaly detection algorithms were utilized to identify unusual patterns and behaviors. These included for example irregular entry times or payment anomalies that did not conform to typical usage patterns. By doing so, the system was able to detect novel or previously unseen types of fraud.

3. Integration and Deployment

Integrating the machine learning models with the existing parking management system was a critical step. Specifically, the key features of this integration included:

Real-Time Analysis: The ML models continuously analyzed transactions and access logs in real time, providing immediate insights into potential fraudulent activities. This capability allowed for swift responses to emerging threats.

Alerts and Notifications: Automated alerts were established to notify the security team of suspicious activities, such as unauthorized access attempts or unusual payment patterns. As a result, the team could quickly address issues before they escalated.

4. Training and Testing

The machine learning models were rigorously tested using historical data to ensure their accuracy in detecting fraud. Moreover, continuous learning mechanisms were incorporated to enable the models to adapt to new fraud tactics. As a result, these models are designed to improve their performance over time, thereby enhancing their effectiveness in combating evolving fraudulent activities.

Results

Achieving Success with Fraud Detection Using Machine Learning

Reduced Unauthorized Access: The ML system successfully detected and prevented 50% more unauthorized access attempts, thereby enhancing overall security. This significant improvement underscores the effectiveness of the system in bolstering security measures.

Decreased Payment Fraud: The classification model identified fraudulent transactions with 90% accuracy, resulting in a 35% reduction in payment fraud. Consequently, the system has significantly reduced financial losses and improved transaction integrity.

Effective Permit Monitoring: Anomaly detection flagged 40% more instances of permit misuse, which facilitated prompt investigation and resolution. As a result, the enhanced monitoring capabilities have led to more effective management of parking permits.

Key Takeaways for Moroccan Parking Operators

Lessons Learned from Implementing Fraud Detection Using Machine Learning

Leverage Comprehensive Data: Collecting detailed and accurate data from various sources is essential for effective fraud detection using machine learning. Indeed, a robust data collection process forms the foundation of successful ML implementation.

Choose the Right Models: Combining supervised and unsupervised learning models can address different fraud scenarios and therefore enhance detection capabilities. By utilizing both approaches, you can achieve a more comprehensive fraud detection system.

Integrate Seamlessly: Integrating ML models with existing management systems ensures effective machine learning-based fraud detection while avoiding disruption to operations. This seamless integration helps in maintaining operational efficiency and maximizing the effectiveness of your fraud detection efforts.

Continuous Monitoring: Regular updates and monitoring of ML models are crucial for adapting to new fraud techniques and maintaining accuracy. Moreover, ongoing evaluation ensures that your system remains effective against evolving threats.

Future Prospects

The Future of Fraud Detection Using Machine Learning in Moroccan Parking and Beyond

The success of this case study demonstrates the significant potential of fraud detection using machine learning in other sectors and regions. Moreover, future advancements are likely to include integrating machine learning with additional technologies, such as IoT sensors and blockchain. By doing so, organizations can further enhance both security and operational efficiency.

Conclusion

Summarizing the Impact of Machine Learning on Fraud Detection in Moroccan Private Parking

Machine learning has proven to be a transformative tool for improving fraud detection in the Moroccan private parking sector. Specifically, by adopting ML solutions, parking operators can not only significantly enhance their ability to detect and prevent fraudulent activities but also achieve better security and operational efficiency.

As a result, ML has become a crucial component in modernizing fraud detection strategies.

Transform Your Fraud Detection Capabilities with Machine Learning Today

Is your private parking business ready to take the next step in fraud detection? If so, contact us today to explore how fraud detection using machine learning can be tailored to meet your specific needs. By doing so, you can significantly enhance your operations and security in Morocco. Don’t miss out on the opportunity to revolutionize your fraud detection strategy.